The federal Liberals are moving ahead with plans to increase taxes on capital gains.

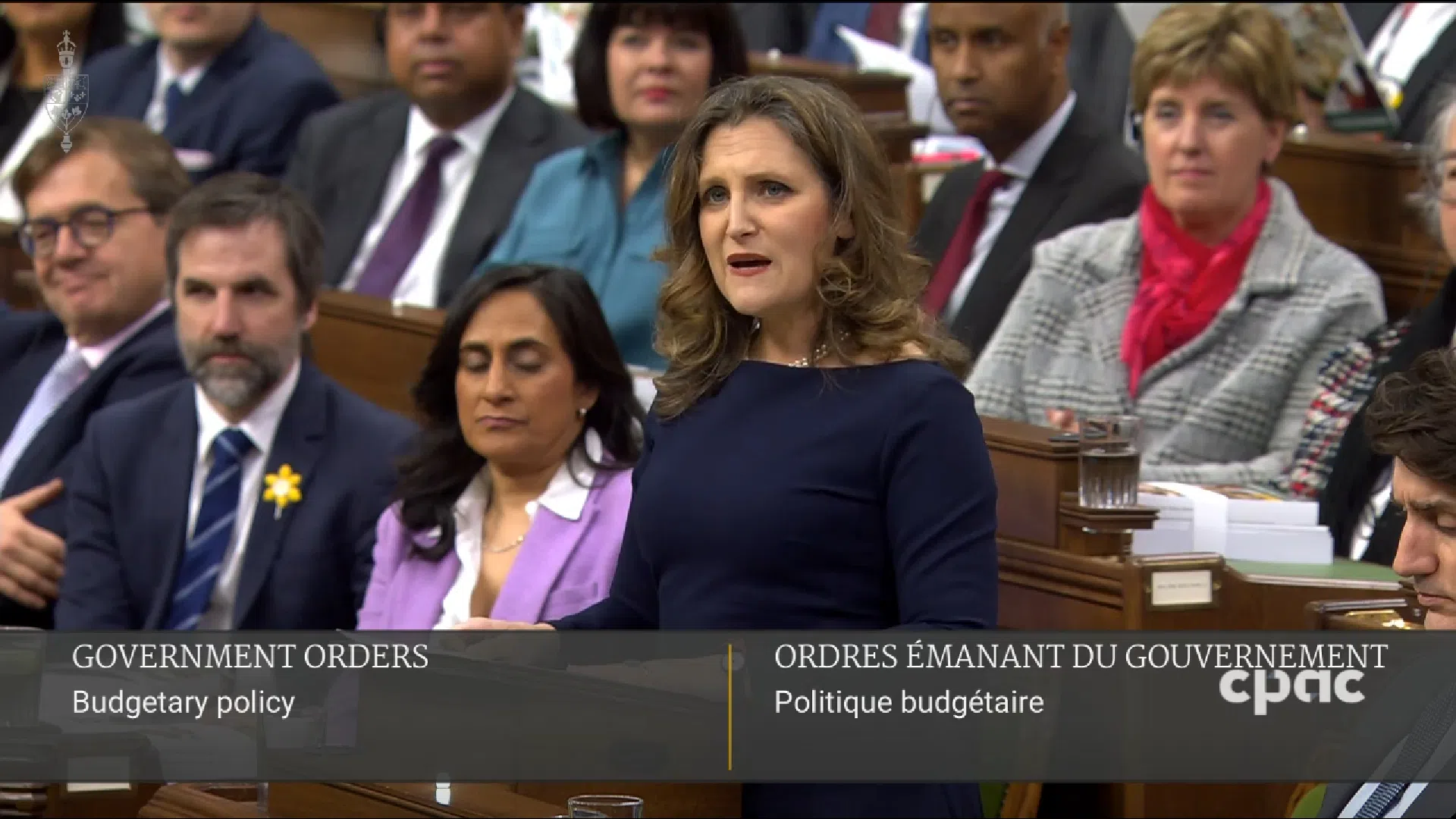

Finance Minister Chrystia Freeland tabled a motion in the House of Commons on Monday.

If approved, the changes will mean higher taxes on the sale of investments and other capital property.

Freeland told reporters that the move will improve tax fairness for all Canadians.

“Because of how investment gains are taxes, well-off Canadians can wind up paying a lower marginal tax rate than a nurse or a plumber. That’s not fairness,” said the minister.

All capital gains are currently taxed at a rate of 50 per cent, meaning half of the profits are added to taxable income for that year.

Under the proposed changes, that rate would increase to 67 per cent for all annual gains above $250,000 for individuals and for all gains made by corporations and most trusts.

That is expected to generate an extra $19 billion in revenue over five years, money Freeland said will help build nearly 3.9 million new homes by 2031.

“Canada could finance these critical investments by taking on more debt, but that would place an unfair burden on younger generations,” she added.

Critics of the capital gains tax changes argue the move will hurt medium-sized business owners and undermine retirement plans for many doctors.

“Most physicians enter practice with significant debt and do not have access to employer or government pension plans, benefits, sick leave, parental leave or paid vacation,” the Canadian Medical Association said in a statement.

“Moreover, physicians invest their own money to build the necessary infrastructure to provide care to patients, while also relying on their professional corporations to save for important life events.”

The association said the changes will “add undue pressure and financial strain on physicians, undermining the stability of our health-care system.”